Attention and decision making

Most of the options we choose between can result in more than just one outcome. When facing such decisions under risk, we often choose the option that does not maximize the expected return. For instance, we tend to prefer a certain gain to a gain which is larger and very likely, but not guaranteed (risk aversion). For a long time, a core aim of behavioral decision research was to describe how such choice patterns deviate from normative economic models.

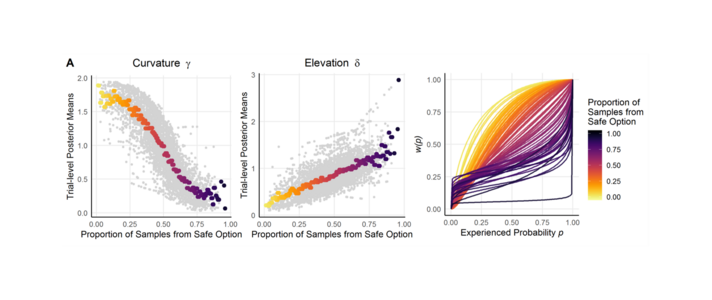

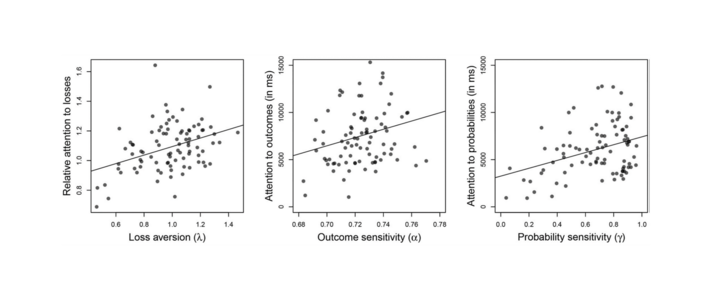

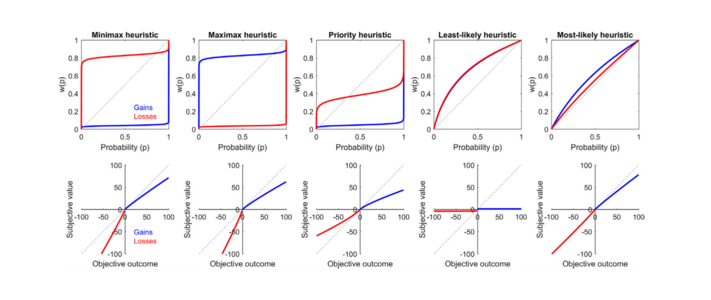

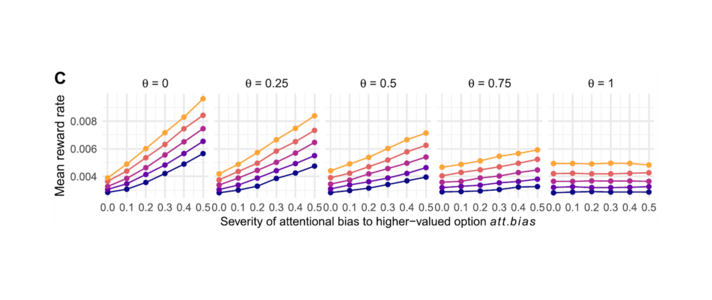

Now, an important follow-up question is why people make these seemingly suboptimal choices (Zilker and Pachur, 2022). To approach an answer, we need to explain how people process the information about choice options to arrive at a preference. For instance, in our research, we investigate whether the way people allocate their attention across decision options affects their final decisions: Pachur et al. (2017) show that the use of simple decision strategies (heuristics) can lead to systematic deviations from optimal decisions, i.e., people fall short of maximizing the expected return. The deviations can be explained by the fact that, depending on the decision strategy, some information about the choice options is ignored whereas are given particularly strong attention. Moreover, Zilker and Pachur (2021) and Pachur et al. (2018) demonstrate how imbalances in attention allocation between either choice options or their attributes can lead to systematic differences in choice patterns and seemingly deviations from economic rationality. However, such imbalances may not be unwarranted: Zilker (2022) shows that attentional biases, i.e., attention is systematically drawn to or away from certain information, can contribute to more efficient choices. Hence, they should not necessarily be considered irrational or suboptimal.